🧩 Currency Pairs & How They Work

In forex trading, currencies are always traded in pairs — you’re buying one and selling another at the same time.

💼 Major, Minor & Exotic Pairs

-

🌟 Major Pairs

These involve the USD and other major currencies. They are the most liquid and widely traded.

Examples:-

EUR/USD 🇪🇺🇺🇸

-

GBP/USD 🇬🇧🇺🇸

-

USD/JPY 🇺🇸🇯🇵

-

-

🌐 Minor Pairs

These don’t include the USD but still involve major global currencies.

Examples:-

EUR/GBP 🇪🇺🇬🇧

-

AUD/JPY 🇦🇺🇯🇵

-

EUR/CHF 🇪🇺🇨🇭

-

-

🧨 Exotic Pairs

These include one major currency and one from a developing or smaller economy. Less liquid, higher spread.

Examples:-

USD/TRY 🇺🇸🇹🇷

-

EUR/ZAR 🇪🇺🇿🇦

-

USD/THB 🇺🇸🇹🇭

-

💱 Base & Quote Currency

Every pair is written like this:

BASE/QUOTE

Example: EUR/USD = 1.1000

-

Base Currency (EUR 🇪🇺): This is the currency you’re buying.

-

Quote Currency (USD 🇺🇸): This is the currency you’re selling (or paying).

➡️ So, 1 EUR = 1.10 USD

📏 Pip, Spread & Lot Size

📌 Pip (Percentage in Point)

The smallest movement in price — usually the 4th decimal.

Example: EUR/USD goes from 1.1000 → 1.1001, that’s 1 pip.

Exception: For JPY pairs, pip is the 2nd decimal (e.g., 110.10 → 110.11 = 1 pip)

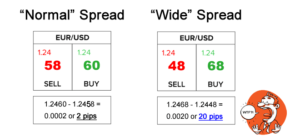

📉 Spread

The difference between the buy (ask) and sell (bid) price.

Example:

EUR/USD

-

Buy: 1.1002

-

Sell: 1.1000

➡️ Spread = 2 pips

👉 This is often how brokers make money.

📦 Lot Size

Defines how much of a currency you’re trading.

| Lot Type | Size (units) | Value per pip (approx) |

|---|---|---|

| 🟢 Standard Lot | 100,000 | $10 |

| 🟡 Mini Lot | 10,000 | $1 |

| 🔵 Micro Lot | 1,000 | $0.10 |

✅ Example Trade

You buy 1 mini lot (0.1) of EUR/USD at 1.1000, and it goes up to 1.1020.

-

That’s 20 pips profit

-

0.1 lot = $1 per pip

-

20 pips × $1 = $20 profit